McDonald's (MCD) has been in the national press of late with notes of franchisee problems. Many understand that McDonald's is partially a real estate story, and is one of the three primary MCD revenue streams. Being in real estate in the early years presented an understandable story to the lending community, that didn't understand $.15 hamburgers. It also was a way to control the franchise structure via a lease, and to take an ownership interest to smooth out early startup losses.

Over time, MCD corporate earnings have been partially reliant on the real estate margin. Early histories on MCD noted an 8.5% total restaurant rent goal and a MCD corporate real estate margin of 25-30%.

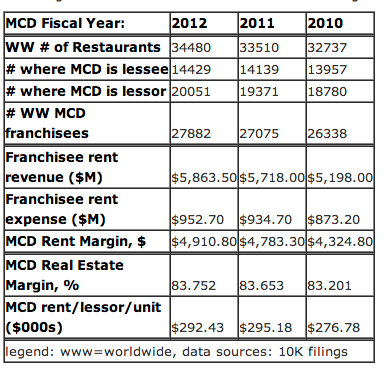

It's risen a lot since those days. Rent expense has generally increased worldwide, but McDonald's rent margin-its markup--has also. See the following extracts taken from the MCD last 10K filings.

The McDonald's rent margin is now almost 84%. This is the function of several factors, including higher store revenues over time, hitting a rent overage threshold that goes as high as 18% of revenue, as well as rent concessions that the landlord McDonald's realized that it did not pass on to the franchisees.

McDonald's rent per franchise lessor site is calculated as above, at over $292,000 per unit, up 26% from 2007. We don't have the exact breakout of McDonald's franchisee revenue for the lessor stores to run a rent percentage, but it rent has to be up. Rent revenue is up more than the number of franchisees, illustrating the issue.

McDonald's is 81% franchised. The franchise economic model has to work for MCD to expand. Restaurant economics were built on 6-8% rent. But the data above suggests actuals are higher.

The missed opportunity of the McDonald's model is that corporate could lower franchisees rents to offset the price discounting it does to hit the Street's same store sales goals-but to do so, it would have to find corporate G&A savings elsewhere to offset the rent decline. That is not on the corporate menu at this point.

John, I know that the California franchisees were heard complaining.

Is this a local problem with rents being out of line, or is it a national problem?

The McDonald's landlord take on the rent does seem to be extraordinary.

However I don't see McDonald's and its shareholders giving any of their rent income back to franchisees any time soon.

The angst is not confined to California.

And you're right Joe, the investors will win this tug-of-war.

Since McDonald's Corp. is always the landlord it's easy to find new tenants. Franchisees are expendable. Not a good business model but that's the way McDonald's has evolved.

Richard -

This is a fascinating dilemma.

McDonald's is an unbelievable and perennial success story for the franchisees and the franchisor.

It will be tough for the franchisees to gain sympathy from shareholders and the public.

What should the franchisees do?

A great start is to get CA Senate Bill 610 passed and signed by Gov. Brown.

It will add freedom of association and the affirmative of good faith and fair dealing to the CA Franchise Relations Act: A simple concept existing in contract law but not in franchise relations law!

Chair Susan Bonilla, CA Assembly Business and Professions Committee will hear this Tuesday morning (8/13/13) Her phone number is (916) 319-2014;

her email is [email protected].

This bill is not just about one segment of one industry. It will make good faith and fair dealing an affirmative right for all 80,000 franchisees in CA.

The investor reaction will just be to get new franchisees. The public reaction, as always, will be to assume that all McDonald's franchisees are multi-millionaires and can afford

to take a hair cut.

But franchisees will cut back on advertising and promotions, first locally and then nationally. They'll stop investing in the endless stream of new technologies and the remodeling program

will grind to a halt.

Kathryn -

How will the CA Bill 610 change anything for the McDonald's franchisees with regard to their leases and rent?

Richard -

You'r spot-on regarding public perception of MCD franchisees.

I think that franchisees will slow their re-investment and MCD will compromise in some way, but not reduce the rent.

Dick,

How do the franchise owners emphasize the significance of this trend to the public analysts?

The Jackson Hewitt franchise owners were not able to do this, and the franchisor tanked into bankruptcy. (At least 5 years before the franchisor failed, the franchise owners were the canaries - they were not expanding their territories.)

Michael - I won't discuss strategy on this public forum but we can assume there will be an increase in communications with the investor community.

McDonald's franchisees in the USA spend more than double their contractual obligation on advertising and marketing their franchises. We may see less McDonald's ads and promotion in the future.

Richard, this is an important point: "McDonald's franchisees in the USA spend more than double their contractual obligation on advertising and marketing their franchises.'" which public analysts have to know more about.

Thanks for point it out. Appreciate it.

Congratulations to John

Readers voted this the Top Story in Week 51, 20014.