Interest in Health Spending Accounts is growing for some fundamental and basic reasons. Today's reality is that governments in Canada and the United States are working to balance their budgets by reducing expenses.

Another reality is that health care expenditures take up a significant portion of government budgets and must be reduced if governments are to be successful in their efforts.

While this funding for services is declining, demand for health care is not likely to subside.

Who will pay for the services that are needed?

In this first of two parts, we explain the basics of Health Spending Accounts. Part two of this article details the services covered.

1. What is Health Spending Account?

Health Spending Accounts are the government's way of helping Canadians pay for their medical expenditures. (Similar devices are available in the US.)

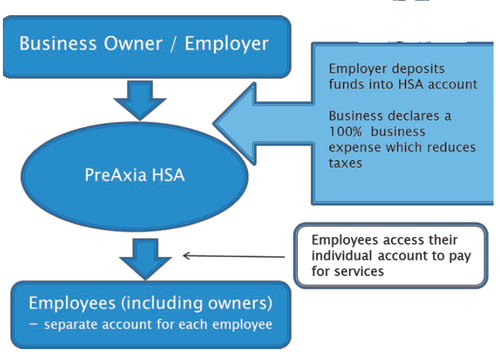

A Health Spending Account is a special bank account administered by a third party. This account can replace or complement other employee benefits.

Employers deposit funds into the account on behalf of their employees. Employees have access to these funds for reimbursement of health care expenditures.

These accounts are available to businesses of all sizes including self-employed individuals where the employer and employee may be the same individual.

Health Spending Accounts are suitable for businesses of ALL sizes.

These accounts must be used solely for reimbursement of medical expenses. Individual business owners channelling their medical expenses through a HSA can save thousands of dollars per year.

2. How does the HSA work? Here is a simple picture.

3. How does the HSA save Money?

This is a bit tricky, but Canada Revenue Agency provides a tax benefit to employers and employees who utilize HSAs for reimbursement of medical expenses.

Leave a comment