I have witnessed, over the past thirty years, that the determination to persevere is often the difference between failure and success.I have also discovered that 46% of salespeople ask for the order one time and then quit. Just 24% ask for the order two times and then never ask again.Simply 14% will ask for the business three times and then quit.Only 12% of salespeople will ask for the order four times and then quit asking.That's a total of 96% who quit selling after four attempts.Yet, research reveals that 60% of all sales are made after the fifth closing attempt.Therefore, 4% of all salespeople are making 60% of all the sales.For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

The Franchise sales process has changed since I began over 20 years ago.Back when I started out, people interested in franchises used the telephone to inquire and request information.Because they saw our ads in the Wall Street Journal or some other important franchising magazine.We talked to them and sent our info packets out through the mail or UPS NextDay. The sales process had begun.But, today franchisors are building costly & elaborate franchise recruitment websites.

Darden was sued in 2009 for a SEC 10b5 claim of unreasonable earnings claims coming from the RARE acquisition, but the Orlando Federal Court dismissed the action in 2009; given the high bar to securities litigation initial motions in the era after the 1995 Litigation Reform Act.

Darden was sued in 2009 for a SEC 10b5 claim of unreasonable earnings claims coming from the RARE acquisition, but the Orlando Federal Court dismissed the action in 2009; given the high bar to securities litigation initial motions in the era after the 1995 Litigation Reform Act.

Full disclosure: I worked a special investigation of Darden's earnings projections after the RARE acquisition and didn't see how then how the acquisition synergies were "reasonable".

Guess what happened.

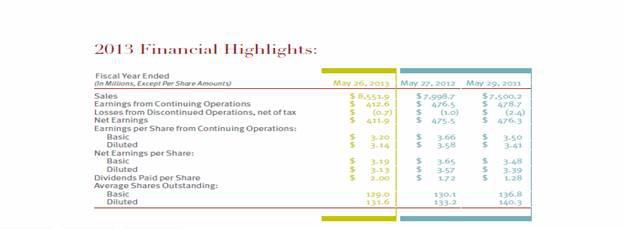

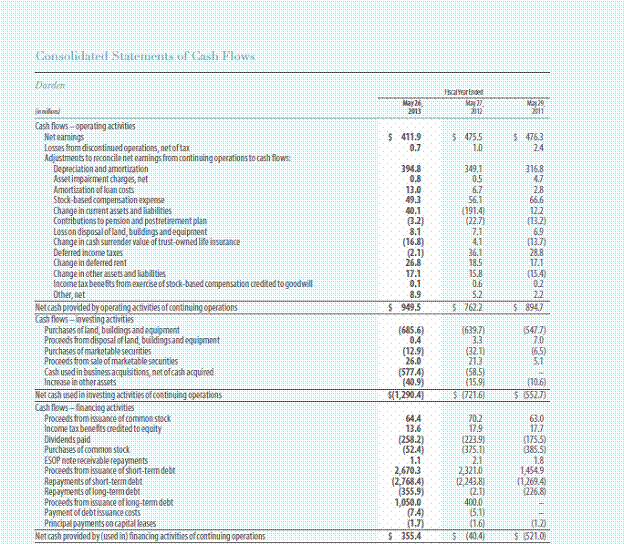

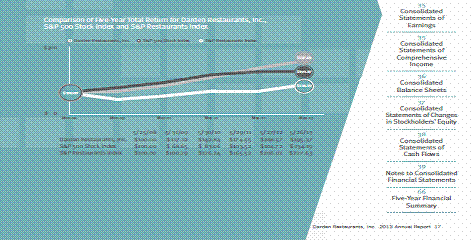

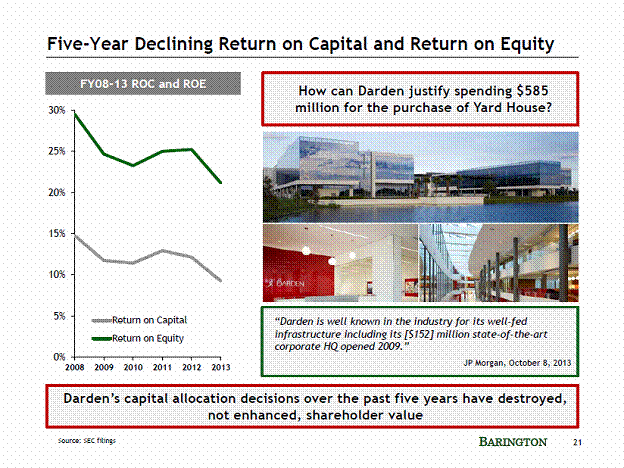

We are now where we are.Darden faced the circumstances of slowing casual dining sales and traffic-which Darden itself did not create, but tolerated-- this weakness was apparent in 2007, before the Great Recession-but also having remodeled Red Lobster, now remodeling Olive Garden and putting a load on CAPEX, building very costly new restaurants--$5-6 million per box, pressure to increase dividends and buybacks...and covering the interest from the RARE, Eddie Vs and Yard House purchases. Check out the following Barington slide: DRI's stock performance lagged in 2012 and 2013.

DRI's stock performance lagged in 2012 and 2013. Barington pounced and was right on some of its calls in its introductory volley on December 17, 2013:

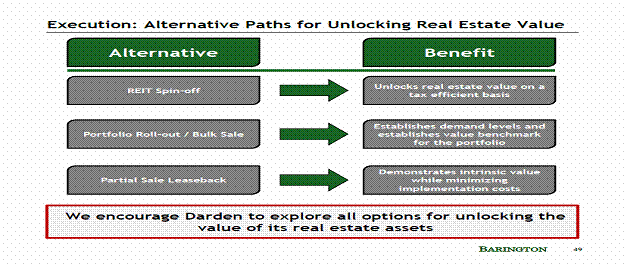

Barington pounced and was right on some of its calls in its introductory volley on December 17, 2013: The Barington pitch was pretty logical until it got to two points:· Spin off the so called high growth brands-Capital Grill, Seasons 52, Bahama Breeze, Yard House, Eddie V-the entire DRI Specialty restaurant group, and· Spin off the owned restaurant real estate into a REIT or sell the underling land.While they weren't operators (Barington had some experience with the now fading Lone Star Steakhouse and the Pep Boys auto oil change chain as investor), they could read balance sheets and saw the company owned a lot of store real estate. Owning real estate was a restaurant financing and development strategy. In the early days it provided a veneer of security for the bankers but it also provided for a great mode of control: there were no landlords to hassle with, no step rent increases in the outyears or costly lease terminations should a site have to be closed. Working restaurant litigation matters as a one element of my consulting practice, I can testify that among the most common are real estate disputes.

The Barington pitch was pretty logical until it got to two points:· Spin off the so called high growth brands-Capital Grill, Seasons 52, Bahama Breeze, Yard House, Eddie V-the entire DRI Specialty restaurant group, and· Spin off the owned restaurant real estate into a REIT or sell the underling land.While they weren't operators (Barington had some experience with the now fading Lone Star Steakhouse and the Pep Boys auto oil change chain as investor), they could read balance sheets and saw the company owned a lot of store real estate. Owning real estate was a restaurant financing and development strategy. In the early days it provided a veneer of security for the bankers but it also provided for a great mode of control: there were no landlords to hassle with, no step rent increases in the outyears or costly lease terminations should a site have to be closed. Working restaurant litigation matters as a one element of my consulting practice, I can testify that among the most common are real estate disputes.Analytical Problems

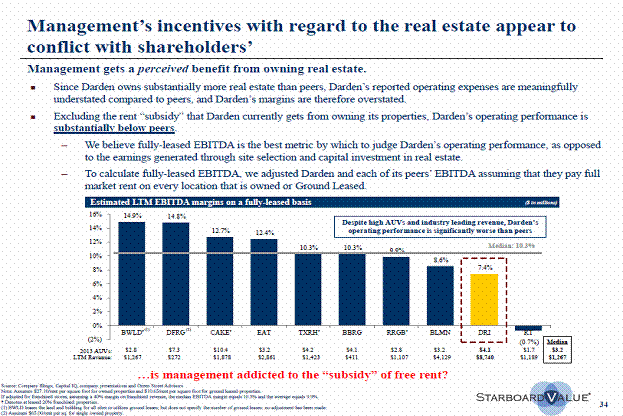

In conference calls, Darden said that its Specialty Restaurant Group was profitable and could stand on its own. That was a bad admission, because almost certainly, that profit basis was an EBITDA value and not a free cash flow basis, which would have covered the CAPEX and debt service cost to build $5 million boxes. Restaurants don't highlight that metric.Barington and Starboard have endlessly speculated on what a Darden REIT could trade for. Of course, there are no restaurant REITS to provide comparables.See the following video from Howard Penny of Hedgeye, supporting Starboard and his super long call on Darden. Note that he touts the potential value of the REIT.Starboard issued a 100 page "Darden Real Estate Primer". Despite all this, Barington and Starboard have failed to prepare analysis on the following key points:1. What is the projected free cash flow profile for the outyears for a separated Olive garden/Red Lobster, and Specialty Restaurant Group?2. What is a realistic REIT cash flow profile for some crappy real estate that Darden owns and needs to get out of? How much will Darden be liable in payments to the REIT?It's not as simple as the Barington slide below, shows: Restaurants and Real Estate

Restaurants and Real EstateMcDonald's (MCD) and Tim Horton's (THI) also are real estate centric, for the control and for the potential for real estate margin. Once the property is paid for, then it's practically a 100% profit flow through. As Jonathon Maze, Editor of the Restaurant Finance Monitor pointed out recently, "restaurant executives tend to take a longer view of real estate. It's a safety value; providing the company flexibility with options should things get bad."

The activists want short term gain, as does Wall Street generally. They tend to talk about "unlocking value". But over what time? Not many contemporary restaurant chains have such real estate intense balance sheets, as restaurant construction and land costs both rose in the 1990s-2000s.The implication in their pitch is that because the real estate is owned and because DRI does not pay cash rent, that it is somehow "sheltering" or incentivizing its RL and OG underperformance. From my long corporate staff experience, the corporate staff members who drive this-don't understand these intricacies at all. See the Starboard slide: Memo to Starboard: any EBITDA metric is a very poor metric to judge performance.

Memo to Starboard: any EBITDA metric is a very poor metric to judge performance.Opinion:

So the real estate can be sold and proceeds generated to generate a big one time dividend, or a first time restaurant REIT will make big news splash. Good for 2015 or 2016 or when this is pulled off. But two questions are raised:(1) Will the decoupling of the real estate fix the problems at Darden?(2) What will you, Darden, do for me tomorrow?The answer to Question One is almost certainly not. In fact, losing control of the real estate to either a REIT or a landlord owner should make it more difficult to reposition either Red Lobster or Olive Garden. Population and retail/restaurant trade patterns shift in the US, and there are too many casual dining restaurants now. That is one of Red Lobsters and Olive Garden's realities that Darden failed to address. While the land has value forever, many restaurant sites have an effective peak economic life of 20-25 years.In terms of Question Two, it seems not clear. The activists have failed to lay out future year cash flows with and without real estate rents, and with and without portfolio breakage. They are talking the REIT valuation in one hundred page detail, however. Wrong entity to think about. Can Darden really close stores and not be stuck with big lease make whole payments? Darden hasn't laid it out clear case either.If it's a church or a dollar store that comes in to backfill some closed Darden sites (two of Darden's closed sites in Indianapolis are that), think about being disappointed, either in the REIT, or decreased cash flow from Darden's core business.When putting together a strategic marketing plan, many franchisors view aspects of their plan in silos.One silo consists of placing advertising in print, broadcast, and digital platforms.A second silo includes public relations initiatives.The third silo involves the social media implementation.This approach may result in some effectiveness; however, integrating the three efforts will provide greater results, especially as it relates to your search marketing efforts and organic lead generation.

Integration is not a naughty word.Search marketing is a vital component of a franchisor's marketing success, and one crucial element is the franchise public relations aspects of the plan.When the PR facets of the plan are defined and implemented, elements like advertising and social media fit together smoothly into the integrated approach.Taking the time to develop strong public relations initiatives is essential, and the following three steps will provide a foundation for future success.Develop Quality ContentIt's important to create quality content that is relevant, fresh, and interesting. Strong content for websites, press releases, and blogs is vital to ranking on search engines like Google, Yahoo or Bing. To develop quality content, it's important to stay organized in the approach. Creating a content calendar to schedule posts and releases is very beneficial, and will benefit the integration of the advertising and social media efforts enormously.Choose Strong KeywordsDeveloping strong keywords will help drive traffic to a site, and increase the effectiveness of press releases and blogs. Selecting strong keywords is key, and for franchise companies it's important to select keywords that describe a product or service. Once keywords are defined, it's important to hyperlink those words back to a website. This will increase the effectiveness of a press release and blog, and will drive a reader to the franchise opportunity page, which is the goal.Strategic DistributionContent must be distributed strategically to be effective. Press releases are often sent through a wire service, which helps increase the reach and publicity of the news on the web.Distributing a news release over the wire ensures releases are delivered directly into the newsrooms of daily newspapers, newsweeklies, national news services (like the AP, Dow Jones, Reuters), trade publications and broadcast newsrooms.Also, keywords in press releases are also beneficial when sending through the wire, because the news feeds devoted to a specific industry are more likely to release.As for blogs, it's important to tie into the social media implementation and share on Facebook, Twitter, Google Plus, and LinkedIn accounts.Integrating strong public relations tactics into a marketing plan will help improve a franchise's marketing strategy and search marketing results, as well as, increase incoming lead generation. Incorporating quality content, strong keywords, and strategic distribution are key ways to communicate your message and services to your customers, and are essential to a business' marketing success.If your franchise business is interested in improving your search marketing plan and would like help creating dynamic content for your public relations and marketing strategy, please contact the experts at Ripley PR.For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

You know that customer loyalty is the best way to get more sales & beat your competition.

There are hundreds, thousands of ways to gain loyal customers.

But, here are 9 easy ways to get better and more loyal customers.Just start now - or give us a call if you need help.1. Know your product and services . . . inside and out.Not being knowledgeable frustrates customers. An uneducated employee is semi-useless to a customer. Job knowledge is key in any position. If for any reason your company doesn't offer job knowledge training, make it your own priority to find out as much as you can. Job knowledge is a key ingredient to serving customers.2. Believe in your product and services 150%.We know of a salesperson who has never had any formal sales training. However, based on the belief in the product, services and contagious enthusiasm, this person is a top seller. People LOVE to buy from people who get excited about their product. Customer service reps are salespeople!!!3. Walk the walk, talk the talk. Practice what you preach.A Ford dealer would not drive a GM car. Employees need to support their company's product or services before they can expect their customers to have confidence in them.4. Keep your word.Companies spend thousands, sometimes millions of dollars advertising their services and products. They tell the customer they are THE BEST, THE ONLY, they are NUMBER ONE. "WE GUARANTEE OUR WORK" isn't enough. Customers need to know that you'll do what you and your advertising says you will. If you claim to provide the 'best of anything,' make sure you keep your word. And be sure all employees keep their word. Telling a customer something will be to them in 7 working days, and then having it NOT show up is a credibility buster.5. Return all calls and emails.It boggles my mind when a call or an email is not returned. There's not an excuse in the world I could buy when that happens. Sure, some of us get way too many calls and aren't able to return them in a timely manner. Well, then have the call returned on your behalf! Not returning an email? How much work does that take? DUH?6. Don't ever forget "who brought you to the dance."In other words, there are always customers who were with you from the start. They helped make your business a success. They believed in you. A nice simple note once in a while is an ego booster to them and you'll feel good about it too.7. Make NO ULTERIOR MOTIVE CALLS or NOTES.Every once in a while, drop a note or make a phone call to customers (and prospective customers) without trying to 'sell' them something. Telephone Doctor labels those "no ulterior motive" calls. They're "just because" calls. . . and very welcomed. When was the last time you heard from a salesperson or a company just to say HI? (See what I mean?)8. Be in a good mood.All the time! Be the person that when the customer leaves or hangs up the phone, they think to themselves, "That was a great call/visit." Not in a good mood? Learn how to be. Remember one of our Telephone Doctor mottos: "A phony smile is better than a real frown." Do you really think the first runner up of the Ms. America contest is as "thrilled for the winner" as she says or shows she is? Talk about a great big phony smile!9. Participate in customer service training programs at your company.Sure you know how to be a good CSR. But everyone could use a refresher. And if there are no programs in place on customer service, ask for them. At best, you'll be ahead of the competition, and at worst, you'll at least be even with them. Customer service is not a department. It is a philosophy. And it's for the entire company. Everyone needs to embrace it - or it doesn't work.A recent IFA Annual Conference speaker, Nancy speaks at franchise meetings across the country.Her passion for the small business is second only to her techniques on sales and customer service.Her reviews at IFA were off the chart. Contact Nancy personally about your meetings.

April 2014 Archives

Here is what my friend, John Lindsey, Sales Trainer says about sales success.