-

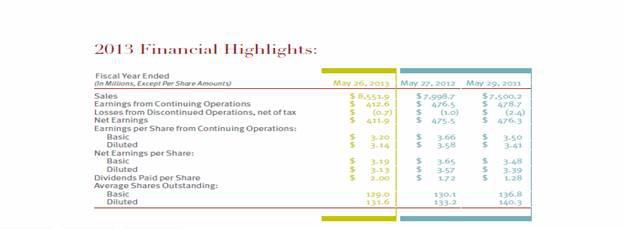

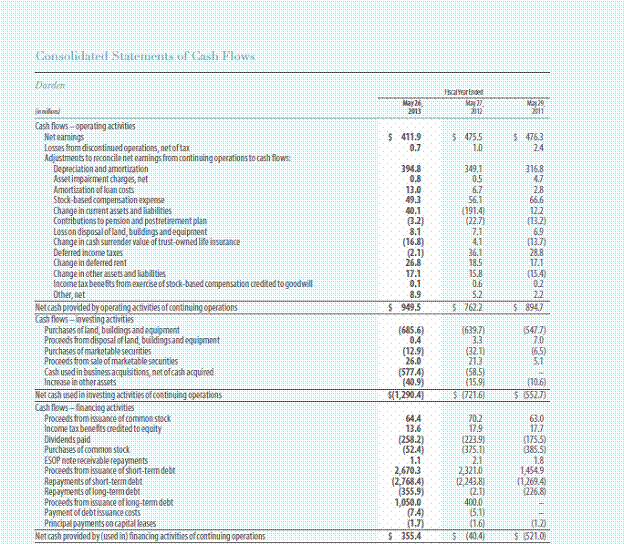

Think beyond Darden's real estate to determine if long term value is present.Both the activists and Darden provided incomplete analysis.Restaurant level EBITDA is a poor metric; free cash flow metric is better.Watching the ongoing war between the Barington and Starboard activists that have stalked the Darden (DRI) casual dining giant since late 2013 has been like watching a tennis game where the two players volley consistently in the air above each others heads. The value of Darden's real estate is the real objective and no one is making the points properly.Imperative for Investors: Ask for more information. Think: do I want my bonus now or later? Does divesting real estate do anything to fix the fundamental issues at Darden? The real essence of the Darden real estate argument hasn't been laid out by either side well, and a lot of analytical foundation is missing. Look beyond the initial real estate splash to assess long term value.Background: Darden Issues Over TimeDarden owns and operates eight casual and upper end fine dining brands. For years it was on a strict 15-20% EPS target. It didn't franchise and until very recently was only US and Canada focused. As the US filled up with restaurants, and as casual dining sales growth began to slow down for many reasons in 2006-2007, it struggled to extract enough pennies and free cash flow to both remodel and execute buybacks and a rich dividend payout.In 2008, Darden executed a $1.4 billion buyout of RARE Hospitality-the operator of Long Horn and Capitol Grill. Two other pricey buyouts occurred later, the small Eddie Vs seafood house in 2011 ($59M) and Yard House in 2012, the small but growing brew house ($585M). The buyouts as a group were costly, at well over 11X EBITDA, with Eddie V's almost 25X EBITDA. In each case Darden promised operating and G&A savings. The problem is, as the activists pointed out, the G&A savings didn't happen. DRI remained focused on the US and didn't even begin franchising or international until 2013 via tiny baby steps. Darden GAAP earnings and free cash flow dollars both were down per their 10K display:

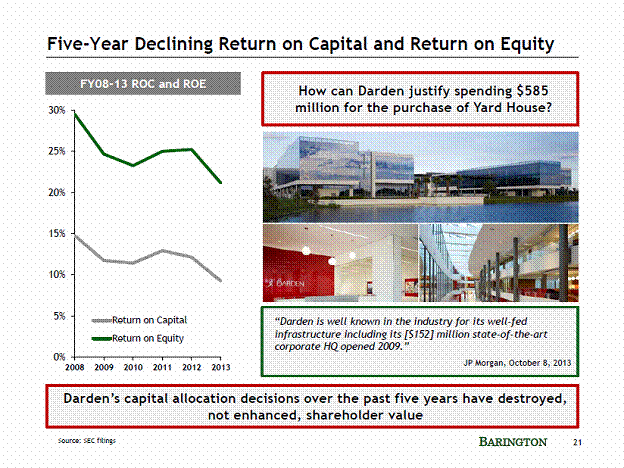

Darden was sued in 2009 for a SEC 10b5 claim of unreasonable earnings claims coming from the RARE acquisition, but the Orlando Federal Court dismissed the action in 2009; given the high bar to securities litigation initial motions in the era after the 1995 Litigation Reform Act.Full disclosure: I worked a special investigation of Darden's earnings projections after the RARE acquisition and didn't see how then how the acquisition synergies were "reasonable".Guess what happened.We are now where we are.Darden faced the circumstances of slowing casual dining sales and traffic-which Darden itself did not create, but tolerated-- this weakness was apparent in 2007, before the Great Recession-but also having remodeled Red Lobster, now remodeling Olive Garden and putting a load on CAPEX, building very costly new restaurants--$5-6 million per box, pressure to increase dividends and buybacks...and covering the interest from the RARE, Eddie Vs and Yard House purchases. Check out the following Barington slide:

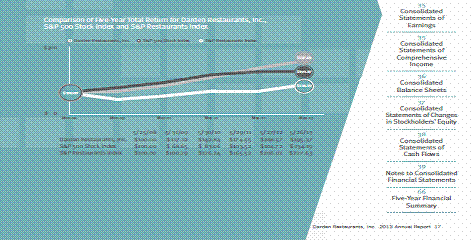

Darden was sued in 2009 for a SEC 10b5 claim of unreasonable earnings claims coming from the RARE acquisition, but the Orlando Federal Court dismissed the action in 2009; given the high bar to securities litigation initial motions in the era after the 1995 Litigation Reform Act.Full disclosure: I worked a special investigation of Darden's earnings projections after the RARE acquisition and didn't see how then how the acquisition synergies were "reasonable".Guess what happened.We are now where we are.Darden faced the circumstances of slowing casual dining sales and traffic-which Darden itself did not create, but tolerated-- this weakness was apparent in 2007, before the Great Recession-but also having remodeled Red Lobster, now remodeling Olive Garden and putting a load on CAPEX, building very costly new restaurants--$5-6 million per box, pressure to increase dividends and buybacks...and covering the interest from the RARE, Eddie Vs and Yard House purchases. Check out the following Barington slide: DRI's stock performance lagged in 2012 and 2013.

DRI's stock performance lagged in 2012 and 2013. Barington pounced and was right on some of its calls in its introductory volley on December 17, 2013:

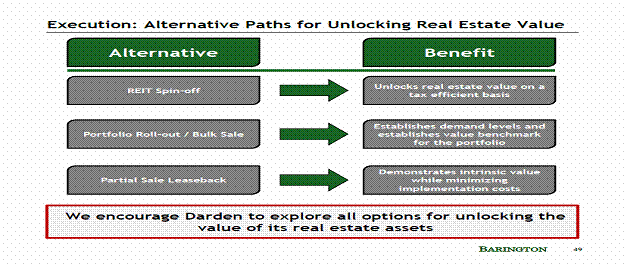

Barington pounced and was right on some of its calls in its introductory volley on December 17, 2013: The Barington pitch was pretty logical until it got to two points:· Spin off the so called high growth brands-Capital Grill, Seasons 52, Bahama Breeze, Yard House, Eddie V-the entire DRI Specialty restaurant group, and· Spin off the owned restaurant real estate into a REIT or sell the underling land.While they weren't operators (Barington had some experience with the now fading Lone Star Steakhouse and the Pep Boys auto oil change chain as investor), they could read balance sheets and saw the company owned a lot of store real estate. Owning real estate was a restaurant financing and development strategy. In the early days it provided a veneer of security for the bankers but it also provided for a great mode of control: there were no landlords to hassle with, no step rent increases in the outyears or costly lease terminations should a site have to be closed. Working restaurant litigation matters as a one element of my consulting practice, I can testify that among the most common are real estate disputes.

The Barington pitch was pretty logical until it got to two points:· Spin off the so called high growth brands-Capital Grill, Seasons 52, Bahama Breeze, Yard House, Eddie V-the entire DRI Specialty restaurant group, and· Spin off the owned restaurant real estate into a REIT or sell the underling land.While they weren't operators (Barington had some experience with the now fading Lone Star Steakhouse and the Pep Boys auto oil change chain as investor), they could read balance sheets and saw the company owned a lot of store real estate. Owning real estate was a restaurant financing and development strategy. In the early days it provided a veneer of security for the bankers but it also provided for a great mode of control: there were no landlords to hassle with, no step rent increases in the outyears or costly lease terminations should a site have to be closed. Working restaurant litigation matters as a one element of my consulting practice, I can testify that among the most common are real estate disputes.Analytical Problems

In conference calls, Darden said that its Specialty Restaurant Group was profitable and could stand on its own. That was a bad admission, because almost certainly, that profit basis was an EBITDA value and not a free cash flow basis, which would have covered the CAPEX and debt service cost to build $5 million boxes. Restaurants don't highlight that metric.Barington and Starboard have endlessly speculated on what a Darden REIT could trade for. Of course, there are no restaurant REITS to provide comparables.See the following video from Howard Penny of Hedgeye, supporting Starboard and his super long call on Darden. Note that he touts the potential value of the REIT.Starboard issued a 100 page "Darden Real Estate Primer". Despite all this, Barington and Starboard have failed to prepare analysis on the following key points:1. What is the projected free cash flow profile for the outyears for a separated Olive garden/Red Lobster, and Specialty Restaurant Group?2. What is a realistic REIT cash flow profile for some crappy real estate that Darden owns and needs to get out of? How much will Darden be liable in payments to the REIT?It's not as simple as the Barington slide below, shows: Restaurants and Real Estate

Restaurants and Real EstateMcDonald's (MCD) and Tim Horton's (THI) also are real estate centric, for the control and for the potential for real estate margin. Once the property is paid for, then it's practically a 100% profit flow through. As Jonathon Maze, Editor of the Restaurant Finance Monitor pointed out recently, "restaurant executives tend to take a longer view of real estate. It's a safety value; providing the company flexibility with options should things get bad."

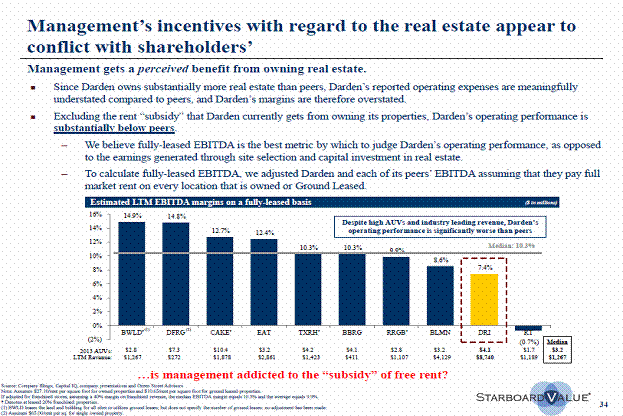

The activists want short term gain, as does Wall Street generally. They tend to talk about "unlocking value". But over what time? Not many contemporary restaurant chains have such real estate intense balance sheets, as restaurant construction and land costs both rose in the 1990s-2000s.The implication in their pitch is that because the real estate is owned and because DRI does not pay cash rent, that it is somehow "sheltering" or incentivizing its RL and OG underperformance. From my long corporate staff experience, the corporate staff members who drive this-don't understand these intricacies at all. See the Starboard slide: Memo to Starboard: any EBITDA metric is a very poor metric to judge performance.

Memo to Starboard: any EBITDA metric is a very poor metric to judge performance.Opinion:

So the real estate can be sold and proceeds generated to generate a big one time dividend, or a first time restaurant REIT will make big news splash. Good for 2015 or 2016 or when this is pulled off. But two questions are raised:(1) Will the decoupling of the real estate fix the problems at Darden?(2) What will you, Darden, do for me tomorrow?The answer to Question One is almost certainly not. In fact, losing control of the real estate to either a REIT or a landlord owner should make it more difficult to reposition either Red Lobster or Olive Garden. Population and retail/restaurant trade patterns shift in the US, and there are too many casual dining restaurants now. That is one of Red Lobsters and Olive Garden's realities that Darden failed to address. While the land has value forever, many restaurant sites have an effective peak economic life of 20-25 years.In terms of Question Two, it seems not clear. The activists have failed to lay out future year cash flows with and without real estate rents, and with and without portfolio breakage. They are talking the REIT valuation in one hundred page detail, however. Wrong entity to think about. Can Darden really close stores and not be stuck with big lease make whole payments? Darden hasn't laid it out clear case either.If it's a church or a dollar store that comes in to backfill some closed Darden sites (two of Darden's closed sites in Indianapolis are that), think about being disappointed, either in the REIT, or decreased cash flow from Darden's core business.2 Comments

Leave a comment

John is right that selling the real estate for a one time gain does nothing to improve operating results.

Great article and great points on EBITA and the perceived value.

What Darden has is a store life cycle problem.

There seems to be very little communication between the departments that handle the actual locations from site selection, demographics and analytics, Legal, Lease Negotiation, New Store Construction, Lease administration and now with FASB/IASB changes becoming firm in 2015, lease accounting, CAPEX budget tracking, and CAPEX projects, and vendor management.

The Site Selection/deal making guys have no central system. If they found a great new location, they would be beat by the more technologically advanced Brinker or Ignite for the site.

No collaboration with Legal keeps lease administration from effectively enforcing things negotiated in the deal (leaky roof, or equipment warranties) and whose responsibility to maintain, repair or replace these item.

All real estate information tracked in Oracle property management, perhaps the worst possible choice for tenant based real estate management for lease accounting (So bad it was thrown out by YUM and GAP and they are both Oracle Shops.)

No defined workflow, longer to build out stores than their competitors like Ruby Tuesdays and Brinker, Ignite, and much longer than fast causual like YUM! or Jack in the box.

In short, they only thing that have any visibility is how to sale/lease back their real estate, which is only a band-aid of cash until they are cash poor again in 3-5 years. Will they use some of the cash to automate and gain visibility into the second largest expenditure behind payroll? Doubtful.

The company is bleeding, doesn't recognize it is even sick and blames Red Lobster for their current stock woes.

The Red Lobster spinoff is a smoke screen. Until this company knows what it has, what is wants to do with it, and what the game plan for growth is, they will continue to be as mediocre as a company as their Lobster-fest promotions are as an ad campaign.